The #1 Startup Accounting Practice You Absolutely Must Be Doing Now (Whether You Are Targeting An Acquisition Or Not)

Accounting

Put Startup Accounting On Cruise Control Now Or Pay The Price Later.

A peer at a recent marketing conference shared with me a harrowing story about how her former startup’s poor accounting almost prevented Google from acquiring them. The lawyers required that every transaction and every dollar was accounted for, and let’s face it, the founding team was more focused on building an acquisition-worthy product than logging every purchase.

It’s unusual for a small business to start with a fully functioning accounting department. In fact, most startups don’t have accountants at all in their infancy, waiting instead until the business is more established and able to grow. This often means that the initial startup accounting is handled by the founders themselves, who are unlikely to know all of the accounting tips, tricks, and loopholes that could make their lives easier.

As a startup founder, your dream is naturally going to be all about your exciting and innovative new business, not accounting, with the ins and outs of accounts payable/receivable, expense management, or profit and loss statements. That being said, running a small business means taking an interest in your startup accounting, because at the end of the day it can be the difference between your new business thriving or sinking without a trace; cash is your weapon and business is your battlefield.

Plus, if an acquisition is even a remote possibility, then you will want to have your financial house in order, or you risk delaying—or even preventing—the acquisition from even taking place, which is a scary proposition.

Why Startup Accounting Is So Important For Success

- Knowing your cash flow: In startup speak, cash flow is called “burn rate” and is the amount of money you spend or “burn” in a given month. Investors will always ask for your burn rate, so make sure you have an expense management system that makes reporting on this easy. It’s best to spend from a single solution so all expenses are consolidated.

- Spending visibility: Seeing every transaction as it occurs is the best prevention for waste, mismanagement and abuse. Let’s face it, co-founders don’t always agree on or have time to discuss purchases, but seeing every transaction as it occurs can save hundreds if not thousands of dollars so you can right the ship before big mistakes are made by co-founders or spending employees.

- Overall financial control: As a startup CEO, you need to be fully aware of your financial position. If you don’t have real-time control over business spending, you’re more likely to encounter overspends that may well put your fledgling business into financial difficulty.

It’s even more important in the realm of acquisitions, because bigger companies will require that all accounts and expenses are reconciled before the acquisition goes ahead. This means that all expense reports need to be closed out, and all expenses must be properly accounted for. If the historical accounting and expense management hasn’t been done properly, it can delay or even prevent getting acquired.

Even if you’re not targeting an acquisition, getting everything balanced and reconciled is crucial for small-business success. So what’s the best way of tackling accounting for startups?

The #1 Startup Accounting Practice – Track And Record Expenses Automatically As You Go

General ledger reconciliation is absolutely critical for any business to complete prior to an audit or an acquisition to ensure that the accounting records are in pristine condition. The general ledger is the master set of accounts that aggregates all transactions recorded for a business. When reconciling the general ledger, you must review individual accounts within the general ledger to ensure that the source documents match the balances shown in each account.

When there are employees who are spending money on behalf of the company, absolutely every expense must be documented and accounted for, whether through a physical receipt an electronic record. However, receipts get lost easily, so consider using technology to remove the time-consuming burden of collecting and matching receipts. Your accountant, your employees, and even your family will appreciate the time savings.

Startup Accounting Done Right

You might think that browsing small business accounting programs would be the best place to start, but in fact the best accounting software for startups isn’t actually software at all—it’s a small business prepaid business debit card. The important word here is prepaid. Using a prepaid business card makes all the difference to healthy startup accounting, for a number of reasons:

- Startup finances are usually tight. Bank loans and credit cards are traditional funding options, but they’re also less likely to be available for smaller, less established businesses. Prepaid cards, on the other hand, don’t require credit checks or business plan scrutiny.

- Speaking of credit, using corporate credit cards as a startup puts not only your business’s credit at risk, but also your own personal credit. With prepaid business cards, there’s no risk of damage to either your business or personal credit records. If you give someone a company credit card and they run up a $30,000 bill, you are personally liable. Bet on your startup, but not with your personal credit.

- Charges and fees are another issue to consider if you’re looking at using traditional credit cards to manage your business expenses. Interest charges can soon mount up on credit card balances, but by prepaying, you’ll remove that extra accounting expense and save more money to fuel your startup.

Why Prepaid Cards Are So Valuable In Startup Accounting

As a startup founder, CEO, CFO, or executive, using prepaid corporate cards is the accounting practice that will save you the most time, money, and stress.

Say NO To Reimbursement Checks – Give Employees Prepaid Corporate Debit Cards

The old-fashioned method of dealing with employee expenses is paper-heavy and labor-intensive. Employees recouping their out-of-pocket expenses by providing receipts and receiving reimbursement checks in return not only takes time and effort for all involved, but also runs the risk of errors or even employee fraud, leading to expense leaks. Stay in “flow” and avoid interruptions when employees are required to bug the founder for a credit card to buy SaaS software or other purchase.

Make QuickBooks Quick With Transaction Imports

Using a prepaid card such as the Bento business Visa business debit card lets you import data and swiftly and effortlessly reconcile expense records. You can download and export all of your expense information at the touch of a button, segmenting data by time, employee, card, tag, or expense category, so you can easily add everything to QuickBooks to ensure the correct figures are used. Bento adapts to your business, so you can spend less time on administrative burdens.

Helping Startup CEOs

Your company may be small at the moment, and you may be the accountant, but trusting your employees with controllable debit cards instead of exhausting precious time on reimbursements or managing all purchasing makes your accounting so much simpler. See your burn rate instantaneously with Bento’s real-time dashboard.

You’ll have peace of mind that your books are correct by using transaction imports instead of clumsy receipt reconciliation processes (although you can always require that employees submit receipts as well if you can’t kick the paper habit).

Helping Startup Executives

Instead of needing to get involved with approving purchases and setting up procedures, use prepaid cards that can each be tailored to your exact requirements—letting you determine exactly who can use them and exactly what can be purchased with them. Your employees can do the purchasing, saving you precious time.

The Bento Solution

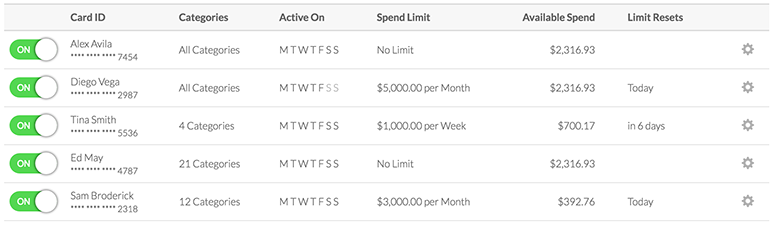

The Bento For Business Visa business debit card is the smart accounting solution for startups. Bento makes employee spending and expense management transparent and effortless. Each individual card can have its own budget and controls. With Bento, you see every transaction as it occurs, in real-time. You can also receive purchase and decline alerts as SMS text messages directly to your smartphone as they occur (business owners LOVE this feature). The Bento dashboard is user-friendly and allows real-time tracking, letting you control budgets, change limits, or even turn cards off with just one click.

Safe, secure, and easy to manage, the Bento business prepaid debit card lets startup CEOs manage their business’s expenses and accounts without needing to be an accountant.

Startups need every advantage possible, and the money and time savings gained from using Bento cards can give your startup the edge it needs to squeeze in one more version or killer feature to get to market quicker and beat out the competition. Take a look at Bento’s Visa business debit card to see why it makes sense for your startup.

About Bento for Business

Bento for Business offers a new generation of technology-driven employee expense cards for SMBs, nonprofits, organizations and associations in the form of a business prepaid Visa debit card. You can set monthly spend limits and allow only certain purchase categories (e.g. Bob the project manager can only spend $500/week and the card only works to purchase gas, hotels and at the hardware store). Turn cards on/off in real-time and receive SMS text message or email alerts for every purchase or decline. Enjoy unmatched visibility into cash flow, eliminate expense reports, and save time & money. Use this link to learn more and start your FREE 60-day trial of Bento’s business prepaid cards.

Want to find out more?

- See how Bento’s analytics and reports help businesses run better.

- Sign up for a free trial.

- Get a customized demo.

Analytics & Reporting

Analytics & Reporting